Factoring and trading company

providing wide range of efficient solutions

We expand opportunities for the growth of your business

ABOUT US

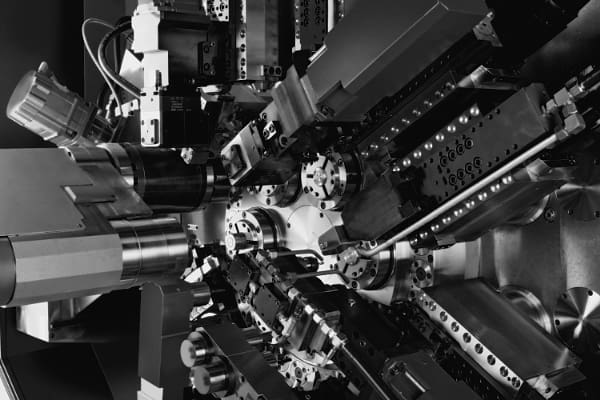

We provide our customers with comprehensive solutions in purchase and usage of the equipment

Factoring is a tool for financing accounts receivable and covering the risks of non-payment on the part of the buyer. It is used to reduce cash gaps by companies operating on deferred payment terms. Its goal is to reduce the cash gaps and provide insurance against non-payments of partners.

Advantages of working with us

To ensure our customers' comfort in equipment purchasing we offer financial support, including factoring and leasing

• We finance clients anywhere in the country.

• Personal manager to support all transactions.

• Electronic document management.

• Financing for assignment of debtors’ debts from any industry.

• Monitoring the debtor’s performance of payment obligations.

• Financing for procurement.

• Payment up to 90% on the day of delivery.

Our services

INTERNAL FACTORING

Service to companies that ship goods, provide services and perform work with full or partial deferral of payment by the buyer within the country

EXPORT FACTORING

EXPORT FACTORING

The service is most in demand among medium-sized businesses that enjoy sharply increased competitiveness of imported goods, often enter international markets for the first time and sell goods and provide services with deferred payment outside the country

PURCHASING FACTORING

PURCHASING FACTORING

Financing of clients for the purchase of raw materials and means of production for the production of goods supplied to the network

FINANCING OF PRODUCTION AND CONSTRUCTION

FINANCING OF PRODUCTION AND CONSTRUCTION

This service is intended for manufacturing and construction companies with capital-intensive nature of production

LEASING

LEASING

Leasing is a transaction where a leasing company finances a business. She does not give money directly to the client, but buys for him the equipment that he has chosen. The entrepreneur uses the equipment as if renting, returns its cost to the lessor in parts and pays for his services.